personal property tax richmond va due date

If the due date falls on a weekend or legal holiday payments are due on the first business day following the due date. What is considered real property.

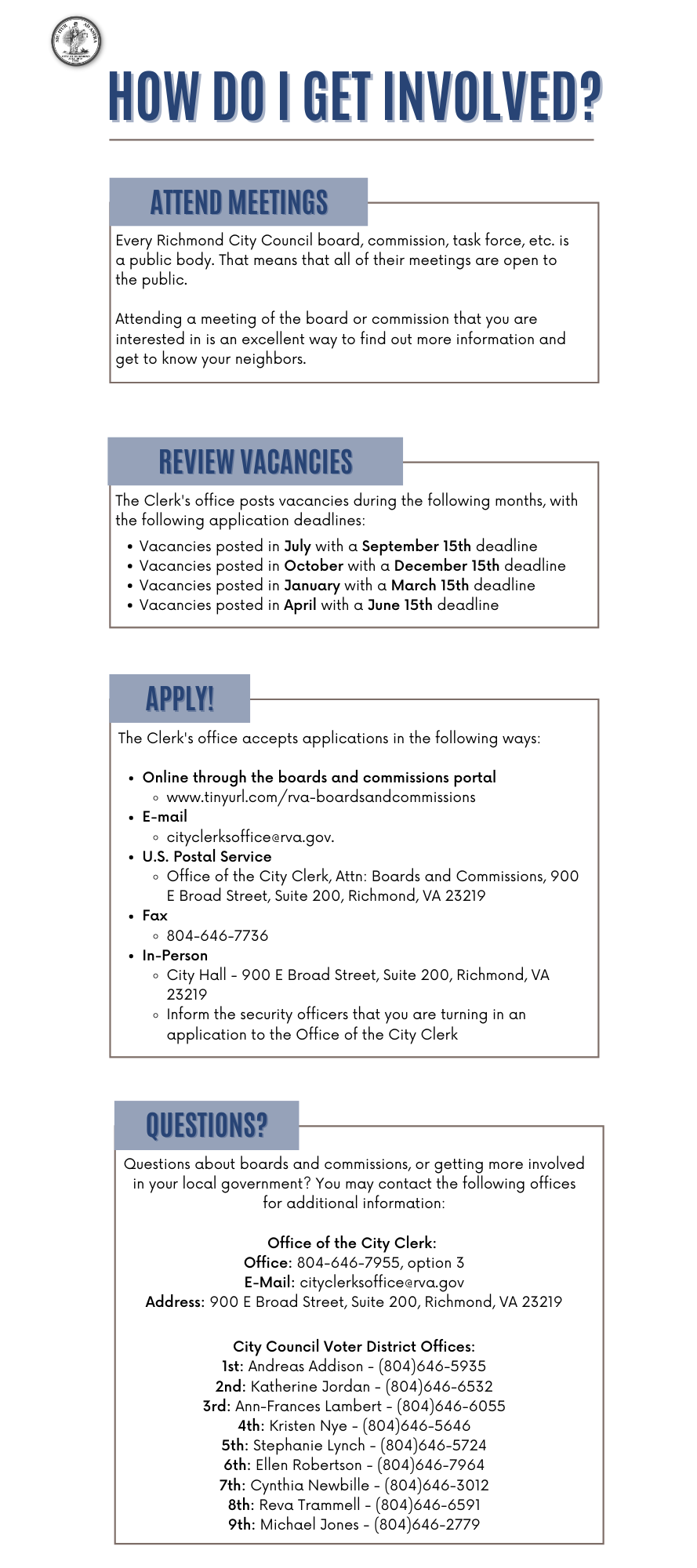

Boards And Commissions Richmond

What seems a large increase in value may actually turn into a tiny increase in your property tax bill.

. State Estimated Taxes Form 760ES - Voucher 2 due. Time for your bank or lending institution to process and mail your payment so that it is received on or. Personal Property Taxes.

Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Installment bills are available online and taxpayers can sign up for paperless real estate and personal property tax bills. Once a transportation hub of Richmond reopened today as an.

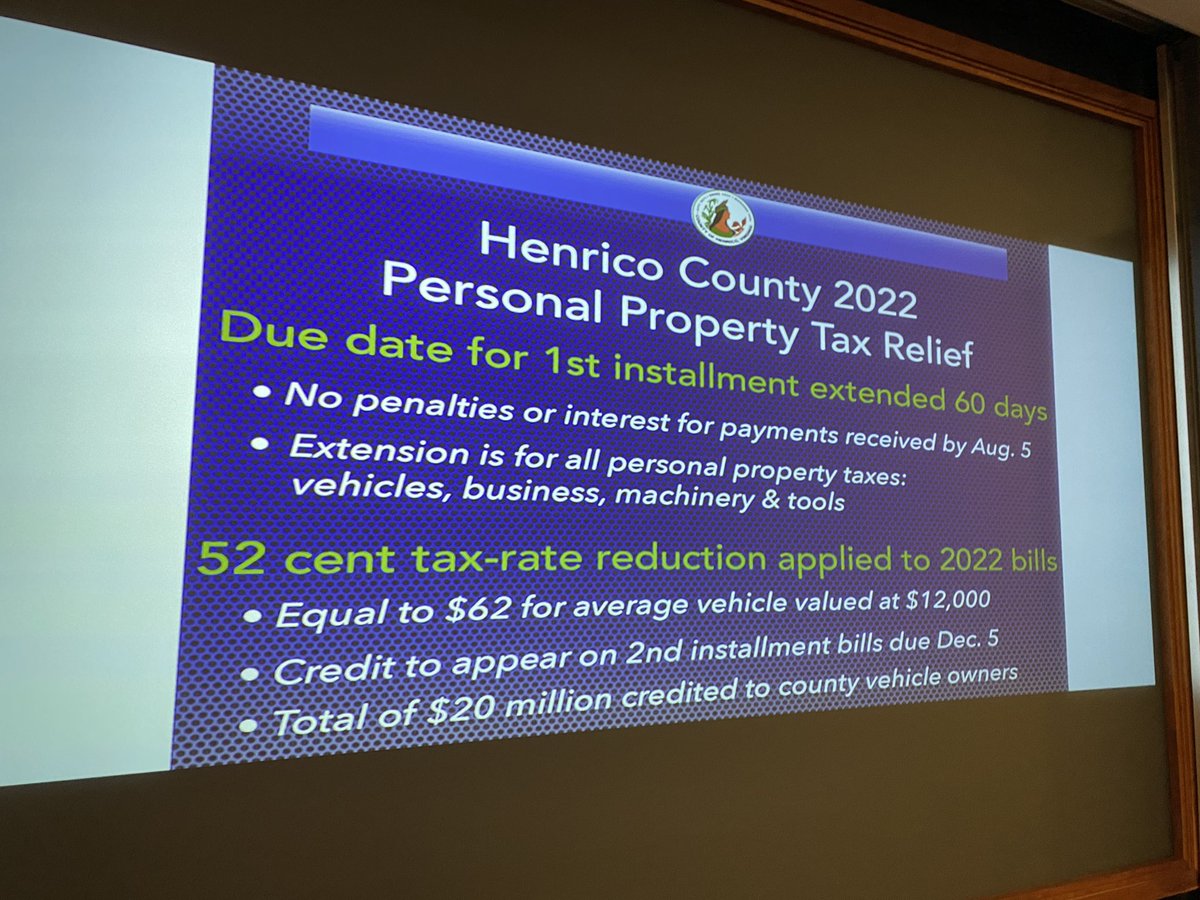

Thoroughly determine your actual property tax applying any exemptions that you are allowed to have. Deadline to file real estate appeal with Board of Equalization. 2 days agoUnder the proposal Henrico would effectively reduce the personal property tax rate by 52 cents for the year from 350 to 298 per 100 of assessed value.

Business Personal Property taxes due to the Treasurers Office. Parking Violations Online Payment. First installment real estate tax payment due.

If the due date falls on a weekend or legal holiday payments are due on the first business day following the due date. Interest is assessed as of January 1 st at a rate of 10 per year. Business Unit The Business and License Assessment Unit is responsible for assessing all tax categories related to businesses operating in the City of Richmond.

FIRST HALF 2022 REAL ESTATE AND PERSONAL PROPERTY TAXES ARE DUE JUNE 6 2022. Real Estate and Personal Property Taxes Due June 6 2022 COUNTY OF SPOTSYLVANIA. Income Tax Rate Indonesia.

Real estate taxes are due on January 14th and June 14th each year. Real Estate and Personal Property taxes are mailed in April and November. At this stage you better solicit for help from.

Personal property tax bills are applicable to the calendar year in which issued. The assessment is for property owned as of January 1st of each tax year. Team Papergov 1 year ago.

Second installment real estate tax payment due. ATTENTION SPOTSYLVANIA COUNTY RESIDENTS. Use the map below to find your city or countys website to look up rates due dates.

Installment bills are due on or before June 5th and on or before December 5th. Box 1478 Richmond Virginia 23218-1478. What is the real estate tax rate for 2021.

Personal Property taxes are prorated and billed annually with a due date of June 5th. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. 804 520-9266 Hours 830 AM - 500 PM.

The 10 late payment penalty is applied December 6 th. Real estate tax rate set by Board of Supervisors. 1 day agoHenrico Countys Board of Supervisors approved an emergency ordinance that extends the due date for personal property taxes and.

Soldier For Life Fort Campbell. 540-772-2006 Staff Directory. Deadline to file real estate assessment appeal with the Department of Tax Administration.

Personal Property taxes due to the Treasurers Office. 1st half real estate tax due. What is the due date of real estate taxes in the City of Richmond.

The real estate tax rate is 120 per 100 of the properties assessed value. Call 804 646-7000 or send an email to the Department of Finance. Box 27412 Richmond VA 23269.

Parking tickets can now be paid online. Personal Property taxes are billed annually with a due date of December 5 th. The Department of Taxation.

-- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on. Click Here to Pay Parking Ticket Online. Opry Mills Breakfast Restaurants.

Use the myStafford Portal to search or pay Personal Property Taxes. Personal Property taxes are due on June 5 and December 5 of every year. WRIC Personal property taxes for those living in Chesterfield are due by June 6 and the countys Treasurers Office wants.

The Billing Collections Office also collects interest at an annual rate of 10 until payment is made. Make an appointment Monday - Friday or stop by at your convenience any day were open. Personal property tax due.

1 day agoand last updated 120 PM May 11 2022. Personal Property Tax Car Richmond Va. Essex Ct Pizza Restaurants.

Restaurants In Matthews Nc That Deliver. Colonial Heights VA 23834 Phone. Personal property tax payments are due December 5th of each year.

May 6 2022 0756 PM EDT. Personal Property Tax Relief. The second due date for an outstanding tax balance is September 2 2022.

Tax Dates and Deadlines Date Deadline. Real Estate and Personal Property Taxes Online Payment. Mon day July 4 2022.

The exact amount of money returned to. If the due date falls on a weekend or legal holiday payments are due on the first business day following. If you have questions about personal property tax or real estate tax contact your local tax office.

If not paid by the due date a penalty of 10 is added as specified in Virginia State Code. 1st half real estate tax bills mailed. Delinquent real estate and personal property bills mailed.

Pay Your Parking Violation. Business Personal Property taxes due to the Treasurers Office. Online Service s.

Tax rates differ depending on where you live. Installment bills are due on or before June 5th and on or before December 5th. Any unpaid taxes after this date will receive a second penalty.

The Treasurer will also collect interest at an annual rate of 10 from the first month following the due date until payment is made. If your tax bill is not paid in full by the due date a late payment penalty of 10 will be assessed on the. Checks should be made payable to.

Delivery Spanish Fork Restaurants. The second due date for an outstanding tax balance is September 2 2022. Personal Property Tax DueVehicle November 15.

/cloudfront-us-east-1.images.arcpublishing.com/gray/LW5BKFRYNVCDTIHZOPO53SL5FI.jpg)

Deadline Arrives For Virginia Time Capsule Submissions

Treasurer Chesterfield County Va

Important Tax Dates Henrico County Virginia

/cloudfront-us-east-1.images.arcpublishing.com/gray/L7SY6CILVFEONGRTGQUS5HK4WU.jpg)

Tax Tips Ahead Of Monday S Deadline

Women Infants Children Wic Henrico County Virginia

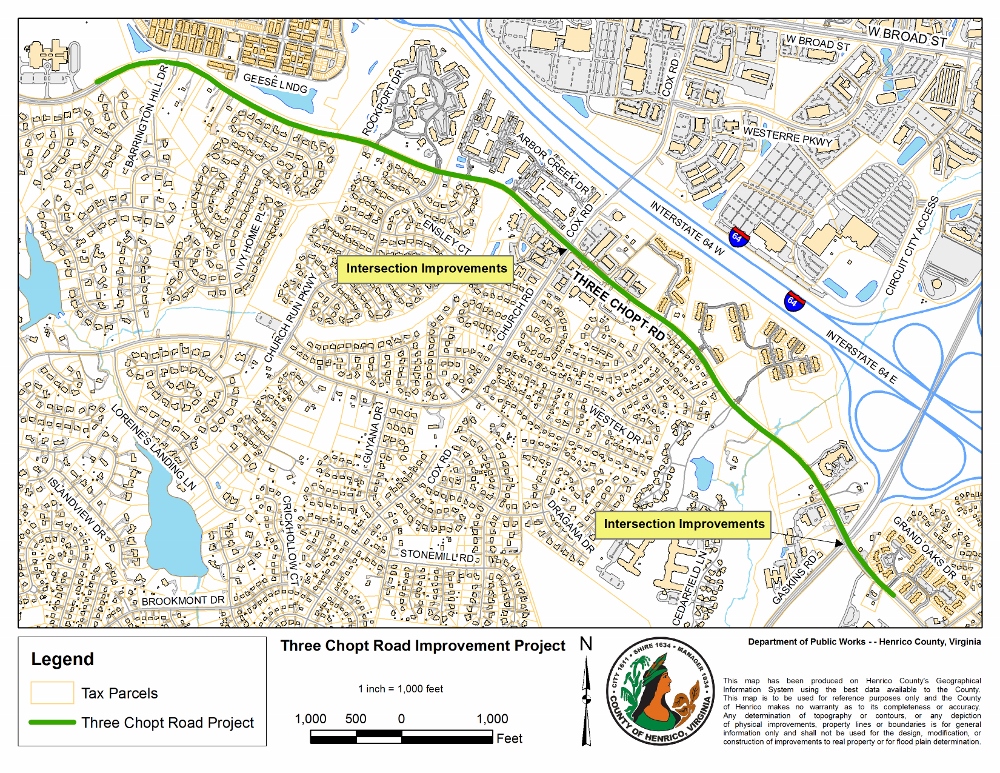

Three Chopt Road Improvement Phase Ii Henrico County Virginia

Man Shot And Killed On Richmond Highway Police Investigating Wric Abc 8news

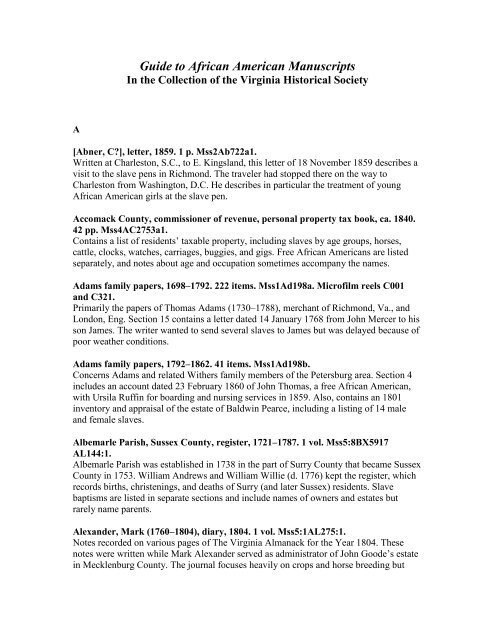

Guide To African American Manuscripts Virginia Historical Society

Boards And Commissions Richmond

/cloudfront-us-east-1.images.arcpublishing.com/gray/HBIHRTTBAFFXXAA26KP54ZULYI.PNG)

Richmond Spca S Dog Jog And 5k Run To Return For 20th Year

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

Deadline To Apply For 2021 Child Tax Credit Is Monday

Virginia Employer Payer 2021 Withholding Tax Deadline Is Jan 31 2022 Virginia Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/KLVZTFPQ65B7DHM5EGCYXUI5IM.jpg)

News To Know For May 2 Shooting Blocks Away From Richmond Raceway Chesterfield Family Claims Their Son Was A Victim Of A Hate Crime Rps Coo Resigns

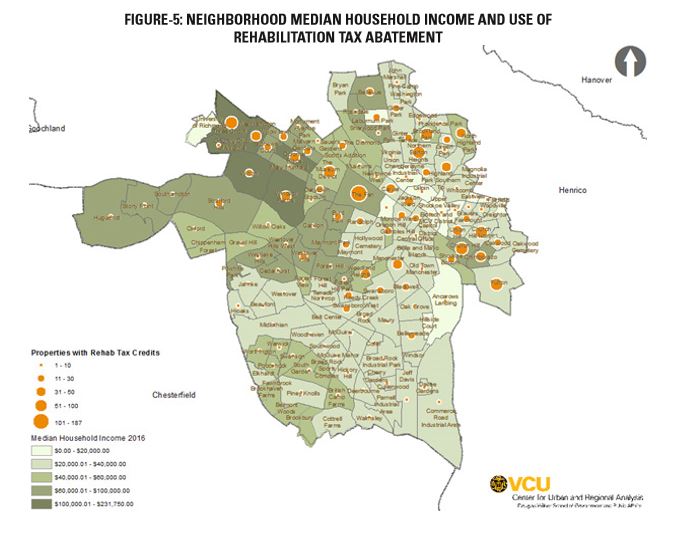

Rehab Tax Exemption Changes Worry City Developers Richmond Bizsense

Deadline To Apply For 2021 Child Tax Credit Is Monday

Boards And Commissions Richmond

Chesterfield Asks For Input About Development Near Route 288